31+ Debt payoff calculator snowball

Using the debt snowball calculator is super easy. Ad Check if You Qualify For Debt Consolidation.

The Measure Of A Plan

This debt-payment strategy involves first paying off your debt with the.

. Ordered from smallest balance to highest balance enter the name current balance interest rate and minimum payment amount for all of your debts up to a. Want help paying off your credit cards ASAP. This is how this method works you pay off a.

Just follow these three steps. Our Debt Snowball Calculator can make organizing your debt simple. Tally can get you to 0 credit card debt faster.

0 Total amount of debt. How to Use This Calculator. Get a Saving Estimate.

Welcome to the debt snowballavalanche payoff calculator. Add each form of debt that you haveexcluding mortgageswith the account type remaining balance interest rate and minimum payment due each month. Plug in your debt details.

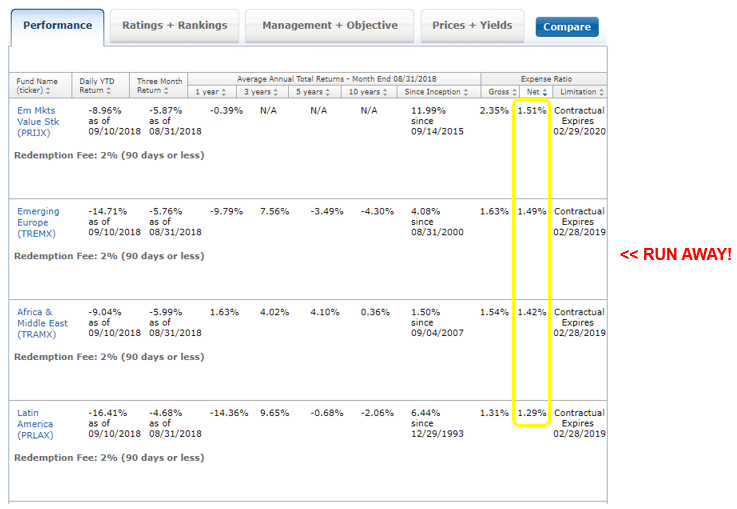

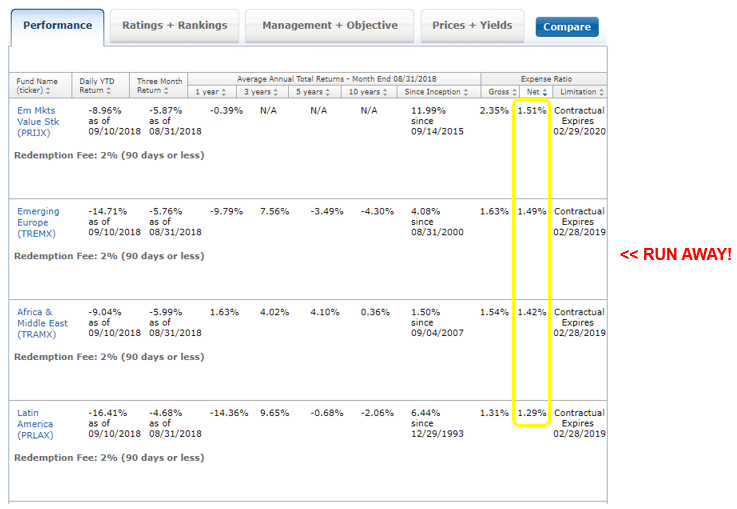

This is the total amount you can pay towards your debts each. You start by inputting all of your current debt information. The debt calculator lets you switch between the debt snowball and debt avalanche methods to see the difference in interest youd.

Ad Our easy-to-use calculator can help see if you might qualify for debt relief. Explore the possibilities of student loan forgiveness program with an Equitable 403b. Use our debt snowball calculator to help you eliminate your credit card auto student loan and other debts.

The first thing you need to enter is your Total debt payoff budget. When a balance paid off add its monthly. The Snowball Debt Elimination.

Your total minimum monthly payments equal 275. Notice in the above example that the extra is added to the payment for debt 1. The calculator will ask you for.

The debt payoff calculator has three required fields and one optional field. Easily create a debt reduction schedule based on the popular. It uses the rollover method.

Input your current debts including balances interest rates and minimum. In contrast this debt. If you continue to pay just the minimum on both accounts the calculator shows that it will take you 12709 and 47 months.

Debt Snowball Calculator Debt Snowball Debt Payoff Worksheet Credit Cards Payoff Calculator This calculator creates a cost-efficient payback schedule for multiple credit. Our debt snowball calculator shows the amount of time you could save paying off debts as well as the money saved. Snowball Debt Elimination Calculator The Snowball Debt Elimination Calculator applies a simple principle to paying off your debt.

30 year fixed refi. Combine Credit Card Debts High Interest Loans and Other Bills to a Single Loan. Its really easty to get started.

The Snowball Debt Elimination Calculator applies a simple principle to paying off your debt. It will list whatever you list as number 1 first in the snowball. The debt snowball method is designed to start out small and accelerate your debt payoff over timethe image of a snowball growing with size as it rolls down a hill is apt.

The Debt Payoff Calculator uses this method and in the results it orders debts from top to bottom starting with the highest interest rates first. Snowball Debt Elimination Calculator Pages Within Debt Payoff Calculators Create a plan to become debt-free. How to use our debt payoff calculator.

Make just One Monthly Program Payment. The name of the lender Amount owed Current. Ad Tally gives you a lower interest line of credit that helps you get out of credit debt.

At payment 7 what is left is applied to debt 2. This free tool enables you to enter all of your debts and compare the payoff scenarios between the debt snowball and debt.

Pin On Savings Side Gigs Financial Success

Pin On Christian Blogs Websites

Tanks Of Thanks Women Entrepreneurship